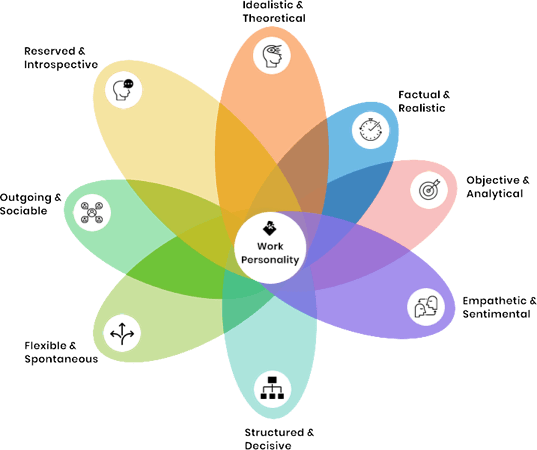

Work "Energy" serves as a fundamental aspect of how you interact with others in your career setting. Understanding your work energy will ensure that you can choose work environments that will energize you rather than deplete you.

When you know what to choose for the right environment for your work energy, you will find that you are more inspired to work, more productive, and more successful. If your thoughts of work make you feel tired, it could be because the career doesn’t align with your preferred work energy.

CareerFitter’s goal is to help you discover the careers that bring you energy when you are working.

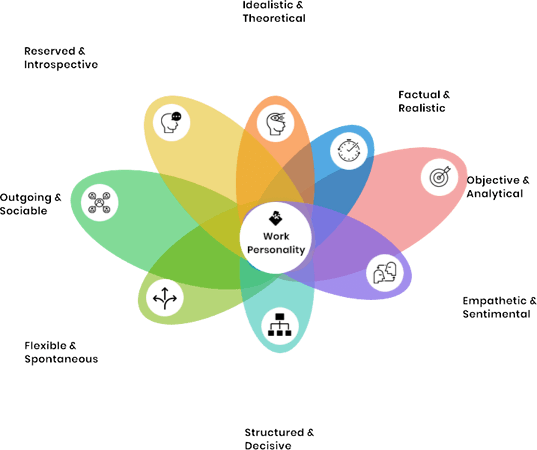

How you perceive the world around you is a factor impacted by your personality. Your personality shapes not just how you perceive your work environment but also how you function within it.

You have innate preferences for interacting with information in the workplace. For example, you may prefer hard facts and data, or you may prefer to work with abstract ideas and theories. Either of these can be a strong advantage when paired with a career that utilizes and benefits from your preference.

Your perception also affects how you approach everyday tasks to problem-solving.

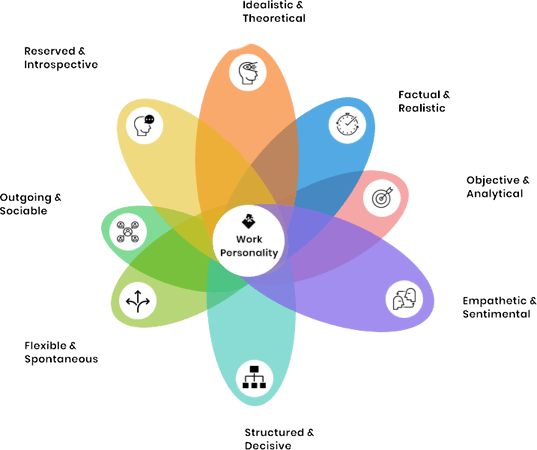

How you make decisions is an important process you engage in daily, regardless of your role, level, or position.

The choices you make, the solutions you support, and the actions you choose to pursue significantly shape not only your advancement trajectories but your team and company as a whole.

There are dominant personality lenses through which you evaluate scenarios, weigh your options, and ultimately make your decisions. It is important that this lens fits well with your career requirements.

CareerFitter helps determine your primary decision-making preferences and strengths to guide you to the careers that require your preferences.

Planning is the step that moves you from intention to execution, and it is impacted by your disposition toward structure and spontaneity.

How you plan when you are working - the methods you use to strategize, organize tasks, and allocate your time, is an important dimension of your personality on the job.

Whether you are a meticulous planner or you prefer to go with the organic flow, your personality characteristics will determine how you navigate work challenges, opportunities, and influence your productivity.

CareerFitter’s work personality assessment is designed to discover your planning preferences and integrate your results with your other dimensions to generate a holistic understanding of your strengths and best career choices.