Claims Adjuster, Appraiser, Examiner, or Investigator

Claims Adjuster, Appraiser, Examiner, or Investigator

Does this career fit your work personality?

Begin The Career Assessment Test- Best Fitting Careers

- Work Personality Strengths

- Work Style Preferences

- and more

Job Outlook

Overall employment of claims adjusters, appraisers, examiners, and investigators is projected to decline 3 percent from 2022 to 2032.

Despite declining employment, about 21,500 openings for claims adjusters, appraisers, examiners, and investigators are projected each year, on average, over the decade. All of those openings are expected to result from the need to replace workers who transfer to other occupations or exit the labor force, such as to retire.

What Claims Adjusters, Appraisers, Examiners, and Investigators Do

Claims adjusters, appraisers, examiners, and investigators evaluate insurance claims. They decide whether an insurance company must pay a claim and if so, how much.

Duties

Claims adjusters, appraisers, examiners, and investigators typically do the following:

- Investigate, evaluate, and settle insurance claims

- Determine whether the insurance policy covers the loss claimed

- Decide the appropriate amount the insurance company should pay

- Ensure that claims are not fraudulent

- Contact claimants’ doctors or employers to get additional information on questionable claims

- Talk with legal counsel about claims when needed

- Negotiate settlements

- Authorize payments

Claims adjusters, appraisers, examiners, and investigators have varying duties, depending on the type of insurance company they work for. They must know a lot about what their company insures. For example, workers in property and casualty insurance must know housing and construction costs so that they can properly evaluate damage from floods or fires. Workers in health insurance must be able to determine which types of treatments are medically necessary and which are questionable.

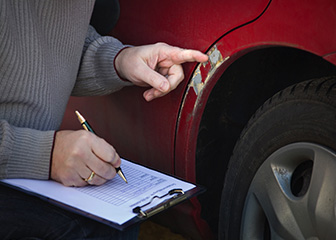

Adjusters inspect property damage or personal injury claims to determine how much the insurance company should pay for the loss. They might inspect a home, a business, or an automobile.

Adjusters interview the claimant and witnesses, inspect the property, and do additional research, such as look at police reports. They may consult with other workers, such as accountants, architects, construction workers, engineers, lawyers, and physicians, who can offer a more expert evaluation of a claim.

Adjusters gather information—including photographs and statements, either written or recorded on audio or video—and put together a report for claims examiners to review. When the examiner approves the claim, the adjuster negotiates with the policyholder and settles the claim.

If the claimant contests the outcome of the claim or the settlement, adjusters work with attorneys and expert witnesses to defend the insurer’s position.

Some claims adjusters work as public adjusters. Often, they are hired by claimants who prefer not to rely on the insurance company’s adjuster. The goal of adjusters working for insurance companies is to save as much money for the company as possible. The goal of a public adjuster working for a claimant is to get the highest possible amount paid to the claimant. They are paid a percentage of the settled claim.

Appraisers estimate the cost or value of an insured item. Most appraisers who work for insurance companies and independent adjusting firms are auto damage appraisers. They inspect damaged vehicles after an accident and estimate the cost of repairs. This information then goes to the adjuster, who puts the estimated cost of repairs into the settlement.

Claims examiners review claims after they are submitted to make sure claimants and adjusters followed proper guidelines. They may help adjusters with complicated claims or when, for example, a natural disaster occurs and the volume of claims increases.

Examiners who work for health insurance companies review health-related claims to see whether the costs are reasonable, given the diagnosis. After they review the claim, they authorize appropriate payment, deny the claim, or refer the claim to an investigator.

Examiners who work for life insurance companies review the causes of death and pay particular attention to accidents, because most life insurance companies pay additional benefits if a death is accidental. Examiners also may review new applications for life insurance policies to make sure that the applicants have no serious illnesses that would make them a high risk to insure.

Insurance investigators handle claims in which the company suspects fraudulent or criminal activity such as arson, staged accidents, or unnecessary medical treatments. The severity of insurance fraud cases varies, from overstated claims of vehicle damage to complicated fraud rings. Investigators often do surveillance work. For example, in the case of a fraudulent workers’ compensation claim, an investigator may covertly watch the claimant to see if he or she does anything that would be suspicious based on injuries stated in the claim.

Work Environment

Claims adjusters, examiners, and investigators held about 329,000 jobs in 2022. The largest employers of claims adjusters, examiners, and investigators were as follows:

| Direct insurance (except life, health, and medical) carriers | 33% |

| Agencies, brokerages, and other insurance related activities | 28 |

| Federal government | 14 |

| Direct health and medical insurance carriers | 8 |

| State government, excluding education and hospitals | 3 |

Insurance appraisers, auto damage held about 13,600 jobs in 2022. The largest employers of insurance appraisers, auto damage were as follows:

| Insurance carriers | 68% |

| Agencies, brokerages, and other insurance related activities | 25 |

| Self-employed workers | 1 |

Claims adjusters and examiners work in offices when reviewing documents and conducting research. They work outside when examining damaged property. Appraisers and investigators work outside more often, inspecting damaged automobiles and buildings and conducting surveillance. Auto damage appraisers spend much of their time at automotive body shops estimating vehicle damage costs.

Workers who inspect damaged buildings must be careful around potential hazards, such as collapsed roofs and floors, as well as weakened structures.

Work Schedules

Most claims adjusters, appraisers, examiners, and investigators work full time. However, their work schedules may vary.

Adjusters often arrange their work schedules to accommodate evening and weekend appointments with clients. This requirement sometimes results in adjusters working irregular schedules, especially when they have a lot of claims to review.

Insurance investigators often work irregular schedules because of the need to contact people who are not available during normal business hours. Early morning, evening, and weekend work is common.

In contrast, auto damage appraisers typically work regular hours and rarely work on weekends.

Getting Started

How to Become a Claims Adjuster, Appraiser, Examiner, or Investigator

A high school diploma or equivalent is typically required for a person to work as an entry-level claims adjuster, examiner, or investigator, although some positions require a bachelor’s degree or insurance-related work experience. Auto damage appraisers typically have either a postsecondary nondegree award or work experience in identifying and estimating the cost of automotive repair.

Education

A high school diploma or equivalent is typically required for a person to work as an entry-level claims adjuster or examiner. However, employers sometimes prefer to hire applicants who have a bachelor’s degree or some insurance-related work experience.

For investigator jobs, a high school diploma or equivalent is the typical education requirement. Some insurance companies prefer to hire people trained as law enforcement officers or private investigators, because these workers have good interviewing and interrogation skills.

Auto damage appraisers typically have either a postsecondary nondegree award or experience working in an auto repair shop, identifying and estimating the cost of automotive repair. Many vocational schools and some community colleges offer programs in autobody repair that teach students how to estimate the cost of repairing damaged vehicles.

Training

Entry-level claims adjusters, examiners, and investigators work on small claims under the supervision of an experienced worker. As they learn more about claims investigation and settlement, they are assigned larger, more complex claims.

Auto damage appraisers typically get on-the-job training, which may last several months. This training usually involves working under the supervision of an experienced appraiser while estimating damage costs, until the employer decides that the trainee is ready to do estimates on their own.

Licenses, Certifications, and Registrations

Licensing requirements for claims adjusters, appraisers, examiners, and investigators vary by state. Some states have few requirements; others require either completing prelicensing education or receiving a satisfactory score on a licensing exam (or both). Jobseekers should verify the licensing laws with the state and locality in which they want to work.

In some states, claims adjusters employed by insurance companies do not have to become licensed themselves because they can work under the company license.

Public adjusters may need to meet separate or additional requirements.

Some states that require licensing also require a certain number of continuing education credits per year to renew the license. Federal and state laws and the outcomes of claim disputes adjudicated in court affect how the claims must be handled and what insurance policies can and must cover. Examiners working on life and health claims must stay up to date on new medical procedures and prescription drugs. Examiners working on auto claims must be familiar with the most recent car models and repair techniques. To fulfill their continuing education requirements, workers can attend classes or workshops, write articles for claims publications, or give lectures and presentations.

The National Insurance Producer Registry (NIPR) provides information about state licensing requirements.

Contacts for More Information

For more information about education and credentials for insurance-related occupations, visit

International Claim Association

National Association of Public Insurance Adjusters

For more information about state licensing requirements, check with your state insurance agency or visit

Similar Occupations

This table shows a list of occupations with job duties that are similar to those of claims adjusters, appraisers, examiners, and investigators.

| Occupation | Job Duties | Entry-Level Education | Median Annual Pay, May 2022 | |

|---|---|---|---|---|

|

Property Appraisers and Assessors |

Property appraisers and assessors provide a value estimate on real estate and on tangible personal and business property. |

Bachelor's degree | $61,560 |

|

Automotive Body and Glass Repairers |

Automotive body and glass repairers restore, refinish, and replace vehicle bodies and frames, windshields, and window glass. |

High school diploma or equivalent | $47,270 |

|

Automotive Service Technicians and Mechanics |

Automotive service technicians and mechanics inspect, maintain, and repair cars and light trucks. |

Postsecondary nondegree award | $46,970 |

|

Construction and Building Inspectors |

Construction and building inspectors ensure that construction meets building codes and ordinances, zoning regulations, and contract specifications. |

High school diploma or equivalent | $64,480 |

|

Cost Estimators |

Cost estimators collect and analyze data in order to assess the time, money, materials, and labor required to make a product or provide a service. |

Bachelor's degree | $71,200 |

|

Fire Inspectors |

Fire inspectors detect fire hazards, recommend prevention measures, ensure compliance with state and local fire regulations, and investigate causes of fires. |

See How to Become One | $65,800 |